Six Eyed Concept

Researches in accounts and telecom

Online Ledger

Posted by on July 5, 2013

Copyright © 2019 • All Rights Reserved

SRS Production Planning and Control

Source Code For Council Infrastructure Project mobile as well as web

Source Code Master Detail Form using Spring MVC , JPA, MySQL and Eclipse Neon

Source Code Master Detail Form using Restful Web Service,Spring MVC , JPA, MySQL and Eclipse Neon

JQuery Popup using db connection

Master Detail Using ODBC Connection to Sybase

Human Services/Complete System Requirement Specification

Webinar Software developed in PowerBuilder 12.6 works on web/mobile(ios and android)

Law Enforcement Management System Business Requirement Document Ver 1.0

Refinery Management System Business Document Ver 1.0

Agriculture Management System Database MySQL 8

Steps to install agriculture project

Agriculture Management System Spring Boot Spring MVC JPA Hibernate MySQL JQuery

Reading 1000 page book in 20 days for passing exam

Kafka Framework with Spring 5.0 Boot and Hibernate

Softwares Used : PowerBuilder 12.5,Appeon 2015,SQL Anywhere

This software when deployed on Appeon works on web on all known browsers as well as on iOS ,Windows and Android phones

For seeing on iphone please download app Appeon. For ios you could download Appeon workspace by going to url http://demo.appeon.com/awsupdate/upgrade_aws.html . Use 2015 Build 0372.It will start downloading the app.Then go to settings > General >Device Management.Trust the appeon app.Within app click + and please enter following URL http://52.32.199.144/mobil and download the native app.

For seeing it on android on the browser of phone please go to url http://52.32.199.144/aem . Then download workspace by clicking Android under login details.Once you do that it will go on download page where it will ask you to download android workspace.Download it and then enter the workspace where you click on + and enter the url http://52.32.199.144/mobil .Once finished go back and you are ready to go.

For seeing the web application please type http://52.32.199.144/bankweb on mozilla, ie or chrome it will ask you to download the Appeon plugin. Download it and you will be ready to go.

***note: Please request for demo because the server may be down.

Six Eyed Concept Unleashed !!

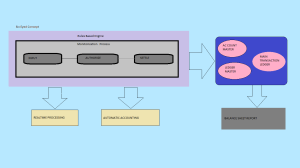

1.1 Introduction :

It is a concept first invented by Devesh Bhatia within the Municipal Waiver Bonds .It consists of three use cases Input,Authorize and Settlement.On each of the use case there are updations on the balance sheet(main transaction ledger) for Receivables ,Payables, Sales Account and Purchase Account within the back office .

Claim for Stroke Management Apparatus

An apparatus comprising step of :

a hub of probes viz part1.exe,part2.exe etc where each part is attached to head and

a hub having a static ip and

each probe having a decoder attached with it url that will be used to trigger fibre optic light from either led or laser and

scheduler generates url with and encoder attached to it and

stroke management that operates remotely through web or smart phones

will be provided

Claim for building fibre

An apparatus comprising step of :

an led,photodiode or any photon generationg emitter connected to tcp/ip socket and

a net socket that would carry and supply photons and

a lifi router configuration where target subnet is decided and

a scheduler(see broadcaster) that would encode each and every url that comes from the client and

the encoder deciding security of the returned object where the encoded url domain is searched on the network and

decoder is the client could be browser or any software or smart phone and

connect infinite subnets based on router configuration and

a pool of encoders scheduled on an operating system model

will be provided

Claim for Light Amplification beating its own speed using Online Transmitter

A process comprising step of :

any light emitter(for e.g photodiode,LED,LASER) and

connect a peer with light emitter usb to a computer or smartphone and

peer must have an ip address and

loop(use do while loop for best results) through the peer emitter of light in a software program when the light is emitted and

loop through the getcontextsertvice with the call by reference of inet as an Internet service which will overload the packets sent on the internet and

create a parameterized bar graph of x-axis being iteration no of loop and y axis being frequency per iteration of loop and

the frequency of wave increases with every iteration and

amplitude decreases initially and as the frequency increases the amplitude increases and the beams amplitude increases and

debugging the graph at step in on every iteration clearly shows the decrease in amplitute of the signal which means the light is travelling faster and faster at every iteration and

update the led ip address in the PoE of your modem properties to check download speed and

light speed that amplifies based on loop and

light that generates no dark matter and

infinite loop amplifies light at infinite speed and

fibre that requires no cabling and is peer to peer and

centralized light emission possible

will be provided.

Claim for Transmitter/Receiver

**********Definition of part : can be smallest screw or whole of the assembly of unit consisting of all the parts

A process comprising step of :

schedule a program of any type viz.,manufacturing processes ,civil engineering,chemical engineering,electronic engineering,electrical engineering,human resources process or medical procedures(2d echo,mri,ct scan ,gynaecological or neurological stroke management and

generate part which is a python file that calls the gcode file generated from cad/cam software and

the python file called from java or powerbuilder or .net or any programming language and

generate the parts to be manufactured in form of units in any file format to be executed and

generate the parts to be diagnosed within medical procedures and

execute every brain stroke or paralysis affected areas of body in form of fibre optics to be projected on affected areas to be healed and

generate parts within schedule that will scan the body with any file types in case of mri and

generate parts of gynaecological processes that will help you to diagnose and

build receiver that will have a file part that will execute the functionality of usb probe which can be a proxy class(for e.g mri scan probe,gynaecological probe,2d echo probe,stroke probe,manufacture item probe,soil dynamics probe,metrology probe,microbiology probe,x-ray probe,sonography probe,biochemical technology probe etc.,) that will broadcast every manufacturing or healthcare procedure and

every part transmits light or electronic signals or a software unit of work

will be provided .

Claim For B2B Engine

A method of integration comprising step of:

targets set for every ledger(for e.g cost price target and selling price targets) and

integration of all systems possible by having workflows against each ledger and

targets for all ledgers set based on any revenue generation formulas like compound interest on receivables and

based on distribution of ledgers allocate the settlement amount for each ledger and

b2b reconciliation with b2c gives rise to profit and loss and

implementation for small business as well as large businesses and

ability to counter depreciation on receivables by setting targets on receivables within the overall ledger framework at multi level and

targets set for all types of ledgers like sales and purchase for e.g selling price is derived based on targets for sales and cost price is derived based on targets for purchase and

target setting that is used to provide incrementation and decrementation of amounts on the variety of ledgers with respect to logical purpose of the ledger and

balancing of ledgers where for each ledger , profit and loss is interpreted where we

get the net figure per ledger , per transaction and gross figure for the whole of the application id on the balance sheet and

the targets are based on receivables received from customer which are only the cost price targets and selling price target and

selling price b2c would update the sales account and cost price b2c would update purchase account respectively and

the deviation would be updated on cost price and selling price profit and loss accounts .

would be provided

Claim for development of B2B Engine using Spring MVC/JPA

A method comprising step of :

screen to retrieve application id,tenor,revenue amount,maturity date and

click of application id populating application id,tenor,revenue amount,maturity date within textbox on next screen and

call stored procedure to calculate coupon amount based on settlement amount and

update settlement amount on respective functional subledgers and

withing stored procedure update coupon table with coupon id ,application id,coupon date and coupon amount and

retrieve coupon table button would display coupons data and

eod stored procedure to calculate b2c amount,deviation and profit/loss updated on maintransactionledger

will be provided

Claim for Revenue amount

amount received in form of either receivables or equity or cash or amount received from investor and

every revenue amount will have a settlement amount and will have corresponding sales,purchase and payables(for e.g. petty cash purchase,petty cash sales and petty cash payables) b2b targets and b2c amounts against every b2b targets and

every b2b transaction will have ledger popup allowing the user to select the ledger id and

each of the particular(equity,cash etc.,) of revenue amount can have different b2b transaction for same application id

Claim for Settlement Amount

A method for generating settlement amount comprising step of :

an amount which gets consolidated on authorization and

amount that is based on revenue generation formulas and other costs to the various levels and

amount that is an amount which may be fixed as well as variable and

amount that should always be broken into coupons that are generated through b2b engine and

amount which could be a debt or credit depending on the ledger for which the settlement amount is created and

consolidated amount that gets settled either through credit(for e.g sales) or debit(e.g purchase or payables)

will be provided

Claim For Net Present Value

A method of generating Net Present Value comprising step of :

settlement amount which is the consolidated amount generated which is the sum of coupons generated which could be a generated at real time amount and

amount settled which is the b2c amount which has to be deducted from settlement amount and

amount settled would be deducted from the respective ledger

would be provided

Claim For Automatic Accounting

A method of automatic accounting that involves three use cases input, authorize and settle comprising step: a)rules based engine to project automatic accounting updating maintransactionledger on every use case input,authorize and settle where there would be an update statement on the database on each of use case that would be the interpretations in form of accounting entries and

b)input use case that would allow user to enter data into the system whose impact would be the 1st updation of maintransaction ledger and

c)authorize use case meaning endorsement of logical payment where logical payment would mean a transaction whose evidence is the money entering the system and

d)settle use case where logical updation(accounting entries updation) which means that debit and credit entries on maintransaction ledger leads to a projection of balance sheet tallying and the amount we have becomes zero will be provided.

Claim For Fast Processing A method of fast processing within six eyed concept comprising step of: A real time speed(any speed) which could even be nano second for every business to generate the accounting positions will be provided.

Claim for Centralized Main Transaction Ledger

A method of generating main transaction ledger comprising of :

Ledger produced by the six eyed concept with centralization where all the accounts have their transactions stored in main transaction ledger through a rules based engine and centralized ledger at international, national and organizational level will be provided

Claim for banking

A method of generating banking application comprising of :

receivables credit which is the amount received from customers interpreted as amount received and

receivables debit and confirmation of payment into system on authorization and

b2b engine generating coupons at a yield whose frequency can be at real time speed and

each coupon is set as a target and

this target is interpreted as consolidated credit or debit in ledgers on authorize when coupons are generated and saved into the system and

when eod is generated frequency based targets are updated on main transaction ledger and

b2c which would mean earnings received from customer where integration between b2b and b2c is the application id and the reconciliation of coupon date and transaction date withing b2c modules is necessary and

automatic profit and loss is interpreted based on rules based engine and

realtime based yield is calculated(hourly,daily etc.,) and

ledgers in b2c like purchase in b2b would mean transactions like credit card,petty cash purchases and schemes like insurances would have workflows which will be reconciled and

ledgers in b2c like payables in b2b would mean transactions like petty cash payables,claims payables,bills payables,withdrawal payables and invoice payables and

ledgers in b2c like sales in b2b would mean transactions like petty cash sales and services sale(viz,credit card,life insurance,forex,equity trading etc., and

updation on total credits and total debits on ledger master based on b2c amount and deviations

will be provided

Claim for multi dimensional profits

A method of generating multi dimensional profits comprising of :

scope of level which could start with transaction,module,application,project,branch,organization,state,country,world and

settlement amount at every level which has an amount settled at every level and

workflows against every ledger producing transactional figures that give the real earnings and

deviations on real earnings reconconciled with b2b coupons at all the levels which would decide net profits based on the targets set when b2b coupons are generated and

multi level gross profits and

profit or loss based on application no depending on deviations between B2C and B2B

would be provided

Claim for generation of international,organizational and national ledger

A method of generating international,organizational and national ledger comprising step of:

centralized main transaction ledger generated in such a way that each of the country,nation and organization is grouped in the data structure with a flag where the group is the hierarchy starting with the world,country and organization and global,national or organizational position generated through the formula of amount we have(Net Present Value) for account master and ledger master and

base of international ledger being application no will be provided

Claim for Multi-Level Balance Sheet

A method for generating multi-level balance sheet comprising step of :

each level of balance sheet would have hierarchical b2b transactions and consolidated settlement amount at all levels would be generated and

amount settled will be generated at all levels and

consolidated settlement amount at all levels would vary based on the variations of a b2b transaction amount settled would be the targetted amount based on b2b coupons at all levels and deleted amount settled would vary the settlement amounts at all levels deleted amount settled at a b2b transaction would keep on debiting targets that are not met at all levels in the same branch within the tree and

a new b2b transaction would lead to a new settlement amount which will be consolidated at all levels and

a new b2b transaction would also credit or debitthe non met targets within the same branch of tree depending on ledger and

change in non met targets would change the yield on real time basis based on formula used to generate coupons a new b2b transaction would change non met targets at all levels because the new b2b transaction would define new targets,every b2b coupon has a timestamp so when the new b2b transaction is generated it would update every non met target at all levels after its last timestamp which is the latest within same branch of the tree.This change of non met targets is decided on new b2b coupon amounts which keep on updating at all levels for its balance of coupon amounts and

application id that would be used to track global transaction at all levels

would be provided

Claim For Generation of Balance Sheet

A method of generating balance sheet comprising step of :

transaction wise balance sheet generated by the six eyed concept depending on rules based engine and flow of the input, authorize and

settle process well displayed on the balance sheet report and

the balance sheet report queried based on the transaction entered within the search criteria and

transaction wise double book keeping fundamentals to avoid the frauds to happen and

balance sheet generated by six eyed concept where one transaction is used in multiple accounts which are interpretations that lead to double book keeping fundamentals based on rules based engine of use cases input, authorize and settle and amount we have for every transaction which would be the difference between settlement amount and

amount settled and the amount we have when compared with receivables credit on the balance sheet that does not have debit where the receivables on balance sheet gives rise to an amount that can raise a credit risk to organization and

the balance sheet that would always tally on settlement only and

balance sheet helping us to track the position of each and every transaction for each and every account and

the debit to every credit in receivables where debit means the confirmation of payment received by the system and evidence of consolidated settlement amount and

process driven balance sheet generation and

tallying process based on thorough monitorization of financial reporting till it reaches the settle use case will be provided.

Claim for Multi-Level Balance Sheet

A method for generating multi-level balance sheet comprising step of :

each level of balance sheet would have hierarchical b2b transactions and consolidated settlement amount at all levels would be generated and amount settled will be generated at all levels and

consolidated settlement amount at all levels would vary based on the variations of a b2b transaction amount settled would be the targetted amount based on b2b coupons at all levels and

deleted amount settled would vary the settlement amounts at all levels deleted amount settled at a b2b transaction would keep on debiting targets that are not met at all levels in the same branch within the tree and a new b2b transaction would lead to a new settlement amount which will be consolidated at all levels and

a new b2b transaction would also credit the non met targets within the same branch of tree and

change in non met targets would change the yield on real time basis based on formula used to generate coupons a new b2b transaction would change non met targets at all levels because the new b2b transaction would define new targets,every b2b coupon has a timestamp so when the new b2b transaction is generated it would update every non met target at all levels after its last timestamp which is the latest within same branch of the tree.This change of non met targets is decided on new b2b coupon amounts which keep on updating at all levels for its balance of coupon amounts.

Claim for Rules Based Engine

A method for rules based engine comprising steps of :

rules would be the interpretations of automatic debit and credit entries updated on maintransaction ledger based on the financial data and the rules that are generated based on impacts of three use cases input, authorize and settle and the updations on the main transaction ledger is based on these rules, in short the rules that decide the flow of transactions to generate the balance sheet and will be provided and

rules based engine would automatically interpret multi dimensional profit and loss based on the types of ledgers and

Claims for ip radar

An apparatus comprising step of :

high frequency antenna where the distance depends on the frequency and power and potential difference and

receiver that receives signals from ip peer and

distance measured from current location to the location ip and

x and y axis from current location displayed on the monitor and

a 3 dimensional point that displays the location from existing location and

speed,time taken to reach and distance chart view displayed on the monitor

,

search ip based on hub without satellite or transmitter but only on internet or tcp/ip and

search ip anywhere in the universe

will be provided

Claim to get 3 dimensional point on the chart from the receiver

A method comprising step of :,

send url with an object containing navigator object pointing to receiver and

handshake navigator pointing to earth to sender and

get the attributes where x,y and z axis are received at handshake from navigator and

generate a report of 3d location of earth

will be provided

Claim for navigator

An object comprising step of :

An object on earth with x,y and z axis all set to zero and

amending x,y and z axis based on the direction of moving object where x,y and z is the earths orbit which does not change and

once x,y and z returns to zero hand shake with earths orbit with nearest x and z axis of earth

will be provided

Claims for inter-planetory broadcasting using the broadcaster

A method of inter-planetory broadcasting comprising step of :

an ip address allocated to any object in space with a dependency of distance ,angular deviation tracking both the ways(angle sought from earth to object and object to earth) and management of deviation in speed and time for audios and videos to reach to and from earth and

a peer to peer network across the ip and

audio or video interchange across the peers through an ip camera and

hitting the audio or video url directly across the peers and

using the broadcaster technology specified below

will be provided

Claims for operating system

A method of operating system comprising step of :

an operating system that works on train,bus,aeroplane,spaceship,mobile,desktop,radio and television and

run a mobile app at a thread that has an abiity to broadcast audios and videos based on the broadcaster below and

a thread that gets loaded on startup of tv,radio,mobile,a maritime vessel network,aeroplane network ,a bus network,a car network or a train network and

a multi threaded or multi peer operating system that broadcasts audios and videos and

a centralized object that runs multiple scheduler threads at centralized location where scheduler sets up the programs that are run on an hierarchical operating system model and

central.ized object that has hierarchy of threads which are nothing but mobile entities having an operating system that runs apps which are various types of broadcasts for eg a college webinar or a baseball match live relay or a cricket match live relay

will be provided

Claims for tv using broadcaster

A device comprising step of :

wifi router inside the device and

ip address allocated to device on start up and

each channel configured based on iteration across the ip network and

each channel having a url and

tv accesible on any mobile phone from anywhere in the universe based on ip and

tv having an ability to video or audio call anyone in the universe on the hub

and

radio access across anywhere in the universe based on ip

will be provided

Claims for Broadcaster(See Webinar Software Video)

A method of broadcasting comprising step of :

a process that is used to enter the schedule admin and

a (tv or radio or phone)broadcast based solely on internet or any other network like TCP/IP and

broadcasting possible from anywhere to anywhere and

schedule a program based on target ip address and audio or video file format and

within scheduler automatic generation of url,no of parts,period per part and program datetime and

book a program and

run a todays program or previous programs and

broadcast a program at today’s datetime or future date and

live broadcasting feature based on any video or audio formats and

a multi channel creation possible within a single web application or a mobile application and

broadcasting without transmitter and

unlimited multiple peers based on ip camera per peer or any media player per peer and

infinite distance possible without transmitter and

access to audios and videos possible solely on network(for e.g tcp/ip or http etc.,)

would be provided

STOCK EXCHANGE

BUY FIXED TO SELL FLOATING RATE

A b2b method comprising step of :

consolidated credit of settlement amount in purchase account based on fixed rate and

b2b purchase target coupons would be generated for application id and

b2b payables target coupons would be generated for application id and

consolidated debit of settlement amount in sales account based on floating rate and

b2b sales target coupons would be generated for application id

a master detail b2b transaction where fixed rate would be header and floating would be detail and

a new rate would generate new b2b coupons based on revenue amount(i.e previous rate settlement amount – total of non met targets amounts for previous rates) with new settlement amount and

previous sales settlement amount will have its non met target coupons debited and

new settlement amount will be created based on floating rate on the new b2b amount within the new b2b transaction or in the detail part of the b2b transaction and

different coupon generation for fixed and floating rate would be generated and

non met targets would be marked as deleted in trans status and

the balance sheet would have transactions which are not deleted coupons trans status

A b2c method comprising step of :

a purchase workflow against ledger id having a purchase order where stock purchase would be recorded and respective purchase account will be debited with the purchase amount on the ledger and

a sales workflow against ledger id having a sales order where stock sales would be recorded and respective sales account will be credited with the sales amount on the ledger and

a payables workflow against ledger id having a payables order where stock payables would be recorded and respective payables account will be debited with the payables amount on the ledger which would be same entry as the purchase as part of the double entry system and

BUY FIXED TO SELL FIXED RATE

A b2b method comprising step of :

consolidated credit of settlement amount in purchase account based on fixed rate and

b2b purchase target coupons would be generated for application id and

b2b payables target coupons would be generated for application id and

consolidated debit of settlement amount in sales account based on floating rate and

b2b sales target coupons would be generated for application id

two fixed rates in same form with different settlement amounts for purchase and sell

the balance sheet would have transactions which are not deleted coupons trans status

A b2c method comprising step of :

a purchase workflow against ledger id having a purchase order where stock purchase would be recorded and respective purchase account will be debited with the purchase amount on the ledger and

a sales workflow against ledger id having a sales order where stock sales would be recorded and respective sales account will be credited with the sales amount on the ledger and

a payables workflow against ledger id having a payables order where stock payables would be recorded and respective payables account will be debited with the payables amount on the ledger which would be same entry as the purchase as part of the double entry system and

BUY FLOATING TO SELL FLOATING RATE

A b2b method comprising step of :

consolidated credit of settlement amount in purchase account based on fixed rate and

b2b purchase target coupons would be generated for application id and

b2b payables target coupons would be generated for application id and

consolidated debit of settlement amount in sales account based on floating rate and

b2b sales target coupons would be generated for application id

a many to many b2b transaction where floating rate would be multiple transactions for sales and purchase both and

a new rate would generate new b2b coupons based on revenue amount(i.e previous rate settlement amount – total of non met targets amounts for previous rates) with new settlement amount and

previous sales settlement amount will have its non met target coupons debited and

previous purchase settlement amount will have its non met target coupons debited and

previous payables settlement amount will have its non met target coupons debited and

new settlement amount will be created based on floating rate on the new b2b amount within the new b2b transaction or in the detail part of the b2b transaction and

different coupon generation for floating and floating rate would be generated and

non met targets would be marked as deleted in trans status and

the balance sheet would have transactions which are not deleted coupons trans status

A b2c method comprising step of :

a purchase workflow against ledger id having a purchase order where stock purchase would be recorded and respective purchase account will be debited with the purchase amount on the ledger and

a sales workflow against ledger id having a sales order where stock sales would be recorded and respective sales account will be credited with the sales amount on the ledger and

a payables workflow against ledger id having a payables order where stock payables would be recorded and respective payables account will be debited with the payables amount on the ledger which would be same entry as the purchase as part of the double entry system and

BUY FLOATING TO SELL FIXED

A b2b method comprising step of :

consolidated credit of settlement amount in purchase account based on fixed rate and

b2b purchase target coupons would be generated for application id and

consolidated debit of settlement amount in sales account based on floating rate and

b2b sales target coupons would be generated for application id

a master detail b2b transaction where fixed rate(i.e previous rate settlement amount – total of non met targets amounts for previous rates) would be header and floating would be detail and

a new rate would generate new b2b coupons based on revenue amount with new settlement amount and

new settlement amount will be created based on floating rate on the new b2b amount within the new b2b transaction or in the detail part of the b2b transaction and

different coupon generation for fixed and floating rate would be generated and

previous purchase settlement amount will have its non met target coupons debited and

non met targets would be marked as deleted in trans status and

the balance sheet would have transactions which are not deleted coupons trans status

A b2c method comprising step of :

a purchase workflow against ledger id having a purchase order where stock purchase would be recorded and respective purchase account will be debited with the purchase amount on the ledger and

a sales workflow against ledger id having a sales order where stock sales would be recorded and respective sales account will be credited with the sales amount on the ledger and

a payables workflow against ledger id having a payables order where stock payables would be recorded and respective payables account will be debited with the payables amount on the ledger which would be same entry as the purchase as part of the double entry system and

CALL OPTIONS

A method comprising step of :

start of stock exchange transaction with call and

credit in receivables would mean amount that is used from de-mat account for

setting targets within the purchase ledger based on the amount received from de-mat and

a b2b option call transaction where updation of consolidated credit of purchase would happen on authorize and

b2b coupons which would be targets would be generated for call option and

b2b coupons are generated based on speculated deal amount which leads to consolidated target amount and

difference between targetted coupon deal amount and b2c deal amount leads to deviations and

a b2c option call transaction would be the purchase order deal done by the customer which a reconciliation of b2b and b2c would happen

would be provided

PUT OPTIONS

a b2b option put transaction where updation of consolidated debit of sale would happen on authorize and

b2b coupons which would be targets would be generated for put option and

a b2c option put transaction would be the sales order deal done by the customer which a reconciliation of b2b and b2c would happen and

option for exchange traded markets and

option for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

SWAPS OPTIONS

Claim for Interest Rate Swaps

A method of financial reporting for derivative comprising step of :

credit in receivables would mean amount that is used from de-mat account for

setting targets within the purchase ledger and sales ledger based on the amount received from de-mat and

b2b coupon setting targets for instruments for purchase and sales account based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c interest rate swap would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

floating interest rate would keep on updating till the transaction is settled and

interest rate swap option for exchange traded markets and

interest rate swap option for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Currency (FX) Swaps

A method of financial reporting for derivative comprising step of :

credit in receivables would mean amount that is used from de-mat account for

setting targets within the purchase ledger and sales ledger based on the amount received from de-mat and

b2b coupon setting targets for currency for purchase and sales account based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c currency fx swap would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

currency fx swap option for exchange traded markets and

currency fx swap option for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Commodity Swaps

A method of financial reporting for derivative comprising step of :

credit in receivables would mean amount that is used from de-mat account for

setting targets within the purchase ledger and sales ledger based on the amount received from de-mat and

b2b coupon setting targets for underlying commodity for purchase and sales account

based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c commodity swap would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

commodity swap option for exchange traded markets and

commodity swap option for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Credit Default Swaps (CDS)

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for default arisen from bonds for purchase and sales account based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c for default arisen from bonds would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

credit default swap option for exchange traded markets and

credit default swap option for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Equity Swaps

A method of financial reporting for derivative comprising step of :

credit in receivables would mean amount that is used from de-mat account for

setting targets within the purchase ledger and sales ledger based on the amount received from de-mat and

b2b coupon setting targets for set of future cash flows for purchase and sales account based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c for set of future cash flows would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

equity swap option for exchange traded markets and

equity swap option for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Total Return Swaps (TRS)

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for return of an underlying asset for purchase and sales account based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c for return of an underlying asset would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

total return swap option for exchange traded markets and

total return swap option for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

CAPS OPTIONS

A highest limit for interest rate on options at multi level would be provided.

COLLARS OPTIONS

EQUITY COLLAR

limits on equity for options at multi level would be provided

INTEREST RATE COLLAR

limits on interest rate for options at multi level would be provided.

SYMMETRIC COLLAR

limits on each leg for options at multi level would be provided

FLOORS OPTIONS

A lowest limit for interest rate at multi level on options would be provided

CALL FUTURES

A method comprising step of :

start of stock exchange transaction with call and

a b2b futures call transaction where updation of consolidated credit of purchase would happen on a future date on authorize and

b2b coupons would be generated for call futures on a future date and

a b2c futures call transaction would be the purchase order deal done by the customer which a reconciliation of b2b and b2c would happen

would be provided

PUT FUTURES

a b2b futures transaction where updation of consolidated debit of sale would happen on authorize on a future date and

b2b coupons would be generated for put futures and

a b2c futures put transaction would be the sales order deal done by the customer which a reconciliation of b2b and b2c would happen and

futures for exchange traded markets and

futures for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

SWAPS FUTURES

Claim for Interest Rate Swaps

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for instruments for purchase and sales account on a future date based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c interest rate swap on a future date would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

interest rate swap futures on a future date for exchange traded markets and

interest rate swap on a future date on a future date for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Currency (FX) Swaps

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for currency for purchase and sales account on a future date based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c currency fx swap on a future date would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

currency fx swap futures for exchange traded markets and

currency fx swap futures for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Commodity Swaps

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for underlying commodity for purchase and sales account on a future date based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c commodity swap on a future date would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

commodity swap futures for exchange traded markets and

commodity swap futures for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Credit Default Swaps (CDS)

A method of financial reporting for derivative comprising step of :

credit in receivables would mean amount that is used from de-mat account for

setting targets within the purchase ledger and sales ledger based on the amount received from de-mat and

2b coupon setting targets for default arisen from bonds for purchase and sales account on a future date based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c for default arisen from bonds on a future date would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

credit default swap futures for exchange traded markets and

credit default swap futures for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Equity Swaps

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for set of future cash flows for purchase and sales account on a future date based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c for set of future cash flows on a future date would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

equity swap futures for exchange traded markets and

equity swap futures for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Total Return Swaps (TRS)

A method of financial reporting for derivative comprising step of :

credit in receivables would mean amount that is used from de-mat account for

setting targets within the purchase ledger and sales ledger based on the amount received from de-mat and

b2b coupon setting targets for return of an underlying asset on a future date for purchase and sales account based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c for return of an underlying asset on a future date would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

total return swap futures for exchange traded markets and

total return swap futures for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

CAPS FUTURES

A highest limit for interest rate on futures at multi level would be provided.

COLLARS FUTURES

EQUITY COLLAR

limits on equity for futures at multi level would be provided

INTEREST RATE COLLAR

limits on interest rate for futures at multi level would be provided.

SYMMETRIC COLLAR

limits on each leg for futures at multi level would be provided

FLOORS FUTURES

A lowest limit for interest rate at multi level on futures would be provided

CALL FORWARDS

A method comprising step of :

start of stock exchange transaction with call and

a b2b futures call transaction where updation of consolidated credit of purchase would happen on a future date along with entailment of credit risk on authorize and

b2b coupons would be generated for call futures on a future date and

a b2c futures call transaction would be the purchase order deal done by the customer which a reconciliation of b2b and b2c would happen

would be provided

PUT FORWARDS

a b2b futures transaction where updation of consolidated debit of sale would happen on authorize on a future date along with entailment of credit risk and

b2b coupons would be generated for put futures and

a b2c futures put transaction would be the sales order deal done by the customer which a reconciliation of b2b and b2c would happen and

futures for exchange traded markets and

futures for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

SWAPS FORWARDS

Claim for Interest Rate Swaps

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for instruments for purchase and sales account on a future date along with entailment of credit risk based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c interest rate swap on a future date along with entailment of credit risk would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

interest rate swap futures on a future date along with entailment of credit risk for exchange traded markets and

interest rate swap on a future date on a future date along with entailment of credit risk for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Currency (FX) Swaps

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for currency for purchase and sales account on a future date along with entailment of credit risk based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c currency fx swap on a future date along with entailment of credit risk would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

currency fx swap futures for exchange traded markets and

currency fx swap futures for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Commodity Swaps

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for underlying commodity for purchase and sales account on a future date along with entailment of credit risk based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c commodity swap on a future date along with entailment of credit risk would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

commodity swap futures for exchange traded markets and

commodity swap futures for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Credit Default Swaps (CDS)

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for default arisen from bonds for purchase and sales account on a future date along with entailment of credit risk based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c for default arisen from bonds on a future date along with entailment of credit risk would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

credit default swap futures for exchange traded markets and

credit default swap futures for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Equity Swaps

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for set of future cash flows for purchase and sales account on a future date along with entailment of credit risk based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c for set of future cash flows on a future date along with entailment of credit risk would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

equity swap futures for exchange traded markets and

equity swap futuresfor over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Total Return Swaps (TRS)

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for return of an underlying asset on a future date along with entailment of credit risk for purchase and sales account based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c for return of an underlying asset on a future date along with entailment of credit risk would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

total return swap futures for exchange traded markets and

total return swap futures for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

CAPS FORWARDS

A highest limit for interest rate on options at multi level would be provided.

COLLARS FORWARDS

EQUITY COLLARS

limits on equity for forwards at multi level would be provided

INTEREST RATE COLLAR

limits on interest rate for forwards at multi level would be provided.

SYMMETRIC COLLAR

limits on each leg for forwards at multi level would be provided

FLOORS FORWARDS

A lowest limit for interest rate at multi level on forwards would be provided

CALL WARRANTS

A method comprising step of :

start of stock exchange transaction with call and

a b2b option call transaction where updation of consolidated credit of purchase would happen on authorize and

b2b coupons would be generated for call option and

a b2c option call transaction would be the purchase order deal done by the customer which a reconciliation of b2b and b2c would happen

would be provided

PUT WARRANTS

a b2b option put transaction where updation of consolidated debit of sale would happen on authorize and

b2b coupons would be generated for put option and

a b2c option put transaction would be the sales order deal done by the customer which a reconciliation of b2b and b2c would happen and

option for exchange traded markets and

option for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

SWAPS OPTIONS

Claim for Interest Rate Swaps

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for instruments for purchase and sales account based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c interest rate swap would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

floating interest rate would keep on updating till the transaction is settled and

interest rate swap option for exchange traded markets and

interest rate swap option for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Currency (FX) Swaps

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for currency for purchase and sales account based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c currency fx swap would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

currency fx swap option for exchange traded markets and

currency fx swap option for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Commodity Swaps

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for underlying commodity for purchase and sales account based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c commodity swap would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

commodity swap option for exchange traded markets and

commodity swap option for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Credit Default Swaps (CDS)

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for default arisen from bonds for purchase and sales account based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c for default arisen from bonds would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

credit default swap option for exchange traded markets and

credit default swap option for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Equity Swaps

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for set of future cash flows for purchase and sales account based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c for set of future cash flows would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

equity swap option for exchange traded markets and

equity swap option for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

Claim for Total Return Swaps (TRS)

A method of financial reporting for derivative comprising step of :

b2b coupon setting targets for return of an underlying asset for purchase and sales account based on interest rate set by reference body(viz., LIBOR) which is associated to bank and

b2b coupons would be generated and

b2c for return of an underlying asset would be the purchase order against purchase target and sales order against sales target where the b2c transaction would contain both buying and selling at the same time and

total return swap option for exchange traded markets and

total return swap option for over the counter markets and

multi level deviations and

arbitration at multi level and

multi dimensional profits

would be provided.

CAPS WARRANTS

A highest limit for interest rate on warrants at multi level would be provided.

COLLARS WARRANTS

EQUITY COLLAR

limits on equity for warrants at multi level would be provided

INTEREST RATE COLLAR

limits on interest rate for warrants at multi level would be provided.

SYMMETRIC COLLAR

limits on each leg for warrants at multi level would be provided

FLOORS OPTIONS

A lowest limit for interest rate at multi level on warrants would be provided

1.2 Input of Six Eyed Concept :

It is the data entered into the system. For eg in current project(Municipal Waiver Bonds) it is the Application ,Front Office , Middle Office ,Coupon Generation ,End of the day and Back office .Based on the data entered into the system the six eyed concept updates data on main transaction ledger based on the process specified below .

1.3 Rules of Six Eyed Concept for Municipal Waiver Bonds(Divisional Patent #1)

1.3.1 On Input(Front Office)

Credit Receivables(Denotes Outstanding)

1.3.2 On Authorize(Middle Office)

Debit Receivables(Denotes Authorization)

Credit Purchase Account(Evidence of a Purchase done by client and the issuer of product is in debt to pay back the returns)

Credit Payables(Evidence that Consolidated Settlement Amount needs to be settled) Debit Sales Account(Evidence that an Income for the customer is expected on settlement )

1.3.3 On Settlement(Back office)

Debit Purchase Account(Denotes a purchase account is debited and returns are paid back for the product)

Debit Payables(Denotes payment being done to client against a settlement )

Credit Sales Account(Denotes that the income for the customer has happened which will decide the profit and loss for the organization)

1.4 Output of Six Eyed Concept :

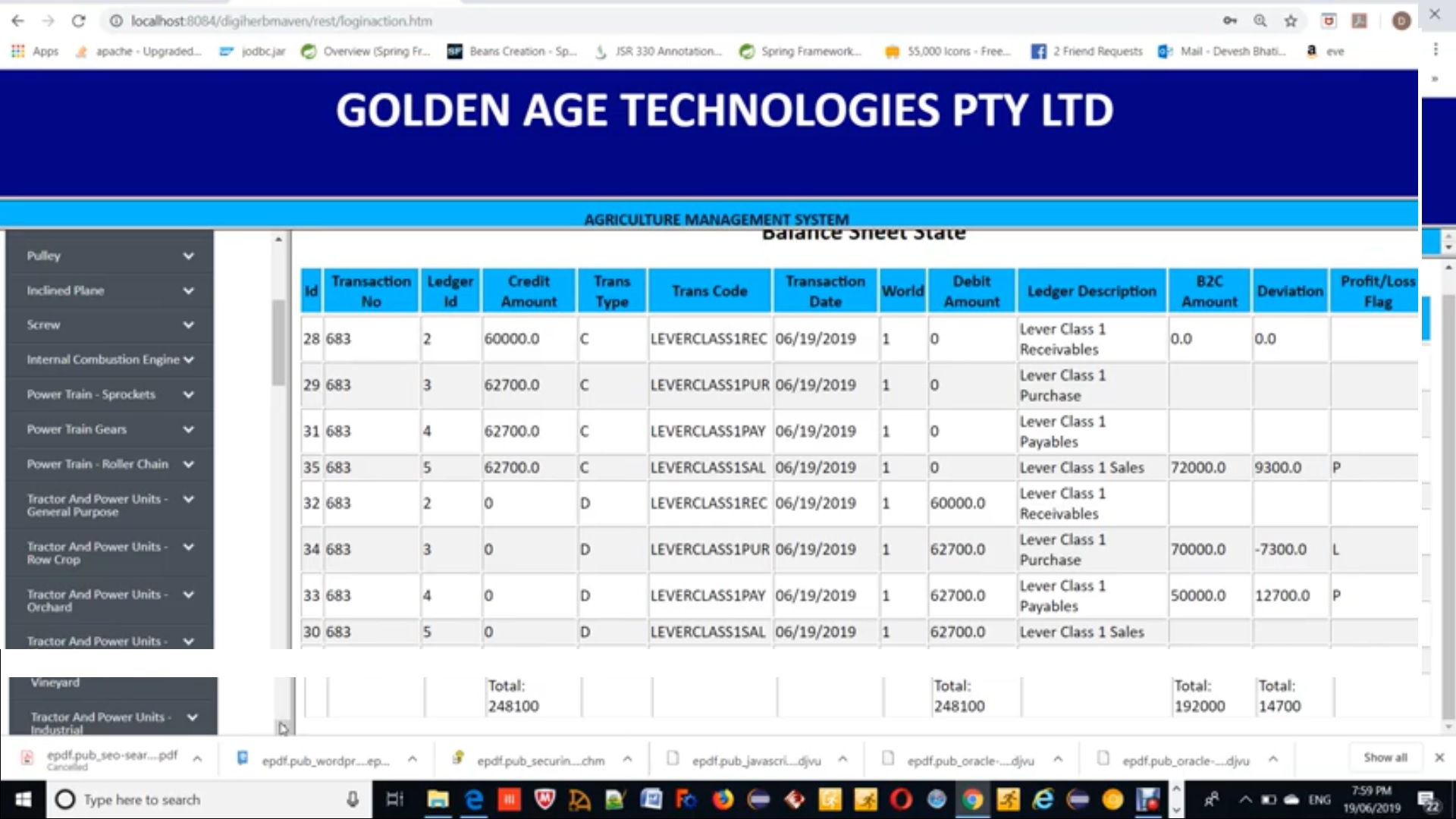

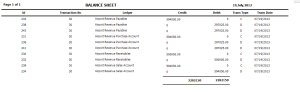

Sample Balance Sheet Generated From Six Eyed Concept

The uniqueness of this balance sheet is it generates trial balance for each and every transaction with debits in receivables (evidence of authorization) and credits in payables (evidence of settlement amount) which makes it distinct to all other balance sheets.

1.5 Importance of Six Eyed Concept :

The rules specified above for tallying the balance sheet would be amended further in applications like :

• HRMS

• Payroll

• Inventory

• Sales order Processing

• Manufacturing

• Supply Chain Management

• Purchase Order System

• Core Banking

• Investment Banking

• Institutional Banking

• Credit Risk

• Sinking Funds

• Billing

There could be many more systems like this where we could generate rules to tally the balance sheet within the six eyed concept .Six Eyed Concept gives us main transaction ledger which is one step higher than the general ledger .The general ledger today gives us a consolidated position of our accounts .Having main transaction ledger would give us a position of each and every transaction in the system .Today we have consolidated Receivables and consolidated Payables where Receivables is the money we got and payables is the money we paid back .In six eyed concept the receivables has debit as well as credit where credit means outstanding and debit in receivables would mean evidence of confirmation of payment input to the system . Even for Payables we have credit and debit where credit would always mean the evidence of settlement amount which in current project(Municipal Waiver Bonds) is the consolidated amount calculated based on compound interest which we would pay back on settlement.This credit in Payables is a unique feature in accounting. So far we used to have only debits in payables .

1.6 Importance of the Main Transaction Ledger

The main transaction ledger gives us the holistic position of an organization with respect to each and every transaction in the system .The main transaction ledger can be used at organization , national as well as international ledger .At every level we could get the position of organization, nation and the world .This would improve the world economy drastically. Today our ledgers are not as sophisticated as the main transaction ledger is within the six eyed concept to give us a position at global level .Before tallying the balance sheet the main transaction ledger has to undergo lots of monitorization processes.

1.6.1 How to create Main Transaction Ledger

CREATE TABLE dba.maintransactionledger (id numeric(20,0) NOT NULL, transaction_no numeric(20,0) NOT NULL, ledger_id numeric(3,0) NOT NULL, amount decimal(15,2) NOT NULL, trans_type char(1) NOT NULL, trans_code varchar(15) NOT NULL, trans_date timestamp NULL,world_desc char(6),country_desc char(7),state,organizational_desc char(10),branch,project,application,module) ;

1.7 Accounting Structure of Six Eyed Concept

We have the account master, ledger master and the main transaction ledger. Account master stores the account descriptions like Receivables, Payables, Purchase Account and Sales Account .The ledger master is a child object of account master and contains ledgers like Airport Revenue Receivables, Airport Revenue Payables, Airport Revenue Purchase Account and Airport Revenue Sales Account (These are just examples). This ledger master also contains the total credits and total debits for each and every account .With such a type of arrangement we could have consolidated total debits and total credits of receivables, payables, purchase account and sales account and also we could have total debits and total credits of the child accounts within the ledger master .Then each and every transaction is recorded in the main transaction ledger based on the rules specified above in the process section of this document.

1.7.1 How to create accounting structure

Account Master

CREATE TABLE dba.accountmaster (id numeric(10,0) NOT NULL, account_code varchar(10) NOT NULL, account_longname varchar(30) NOT NULL, account_shortname varchar(15) NOT NULL) ;

Ledger Master CREATE TABLE dba.ledger (id numeric(10,0) NOT NULL, ledger_code varchar(8) NOT NULL, ledger_description varchar(50) NOT NULL, account_id numeric(10,0) NOT NULL, total_credits decimal(15,2) NULL, total_debits decimal(15,2) NULL,gross_profits decimal(15,2) NULL,net_profits decimal(15,2) NULL) ;

1.8 Importance of Balance Sheet Generated by Six Eyed Concept

The balance sheet generated by the six eyed concept is for each and every transaction within the system .It gives us the flow of how the transactions are moving till the settlement occurs .In this balance sheet we are also meeting the book keeping fundamentals of double entry book keeping. This is based on the interpretations provided by the six eyed concept while we perform in the end to end processes of input ,authorize and settle .This balance sheet also gives us the opening balance which is the credit in receivables and closing balance which is the credit shown in the sales account which is interpreted as generation of sales turnover for a transaction on the settlement as well as the account balance closure .The market today provides us the balance sheet which gives us a consolidated position only .Six Eyed Concept has an upper edge that provides us the balance sheet which is for each and every transaction .

1.9 Why Six Eyed Concept

• Automatic Accounting

• Fast Processing

• Centralized Main Transaction Ledger

• Transaction wise balance sheet

• Transaction wise double book keeping fundamentals acheived

• Ability to produce business positions at real time, end of day ,end of month and end of the year

• Rules based engine

• Generic workflow for every type of system

• Process based balance sheet generation

• Efficient management of accounts

• Generation of Business positions at organizational , national and international level

• Reduced labor

• Reduced cost

• Generation of a sophisticated ledger

• Use case specific models

• Uses Artificial Intelligence and Expert System for its rules based engine

• Balance Sheet tallying on settlement only

• Efffective Monitorization of financial data before tallying balance sheet

• Ability to have global transaction because of multi level balance sheet

1.9.1 Real Time Accounting(Divisional Patent #8)

With Six Eyed Concept real time accounting can be achieved which is again a unique feature. The real time accounting would mean that if on a scheduler you set the rules to be fired at a time, then they will get fired thereby generating a trial balance .For implementing real time accounting, stored procedures parameterized with a date and time variable is executed .This date time variable is queried in the sql statements based on which the stored procedure queries the system for that date time which has the accounting amounts. These accounting amounts are updated on the main transaction ledger in such a way that they are interpreted as accounting debits and credits. The date time parameter could be any time even micro second.

1.9.1.1 Sample Stored Procedure to Run on Scheduler for Municipal Waiver Bonds

CREATE PROCEDURE “DBA”.”sp_eod_airport_revenue” @eoddate timestamp as

begin

SET EXISTING OPTION public.string_rtruncation = ‘off’

declare @li_max integer, @li_bond_no integer, @settlement_amount money, @gldebit money, @glcredit money, @purchcredit money, @purchdebit money, @recdebit money, @reccredit money, @paycredit money, @paydebit money, @coupon_settlement money

/**** Perform debit on purchase account****/

/**In the query below please modify varchar(10),@eoddate and coupon date with respect to datetime**/

insert into maintransactionledger( transaction_no,ledger_id,amount,trans_type,trans_code,trans_date) select a.bond_no,’1′,a.amount,’D’,’AIRBOND’,getDate() from airportrevenuecoupon as a where convert(varchar(10),@eoddate,120) = convert(varchar(10),a.coupon_date,120) and a.trans_status = ‘I’

/**** Perform debit on payables****/

insert into maintransactionledger( transaction_no,ledger_id,amount,trans_type,trans_code,trans_date) select a.bond_no,’3′,a.amount,’D’,’AIRBOND’ ,getDate() from airportrevenuecoupon as a where convert(varchar(10),@eoddate,120) = convert(varchar(10),a.coupon_date,120) and a.trans_status = ‘I’

/*** Set The transaction to settled for coupons***/

UPDATE airportrevenuecoupon SET trans_status = ‘S’ where convert(varchar(10),@eoddate,120) = convert(varchar(10),coupon_date,120) and trans_status = ‘I’

/** Update Total Debits and Total Credits***/

select @paydebit = sum(amount) from maintransactionledger where trans_type = ‘D’ and ledger_id = 3

select @paycredit = sum(amount) from maintransactionledger where trans_type = ‘C’ and ledger_id = 3

update ledger set total_debits = @paydebit,total_credits = @paycredit where id = 3

select @recdebit = sum(amount) from maintransactionledger where trans_type = ‘D’ and ledger_id = 2

select @reccredit = sum(amount) from maintransactionledger where trans_type = ‘C’ and ledger_id = 2

update ledger set total_debits = @recdebit,total_credits = @reccredit where id = 2

select @purchdebit = sum(amount) from maintransactionledger where trans_type = ‘D’ and ledger_id = 1

select @purchcredit = sum(amount) from maintransactionledger where trans_type = ‘C’ and ledger_id = 1

update ledger set total_debits = @purchdebit,total_credits = @purchcredit where id = 1

/**Update general ledger total debits and total credits***/

select @gldebit = sum(amount) from maintransactionledger where trans_type = ‘D’

select @glcredit = sum(amount) from maintransactionledger where trans_type = ‘C’

update ledger set total_debits = @gldebit,total_credits = @glcredit where id = 4

end;

1.9.2 Why Maintransaction Ledger

The Main Transaction Ledger is needed because it is generated based on rules. It would give us a holistic position of an organization or nation or world. It could be centralized at all levels easily. It is directly connected to all the workflows where we don’t need to rely on Journal Vouchers. The accounting structure is a tree of accounts where we could get consolidated positions at account master level or at one step below it at ledger level which is favourable for consolidated accounting positions as well as the ledger level positions or at a transaction level position which no accounting system in the world provided.

1.9.3 Why Transaction Wise Balance Sheet

Six Eyed Concept generates transaction wise balance sheet .This type of balance sheet helps us to track the position of each and every transaction for each and every account. This type of balance sheet is generated by a rules based engine in six eyed concept. It tallies on settlement only where the Net Present Value becomes zero for that transaction that tallies which is a very unique and niche feature of six eyed concept which is not achieved by anyone in the world.Having a balance sheet that’s not transactionwise would mean that we are not able to compute NPV neither can we have transaction wise arrears or a consolidated settlement amount for a transaction which will lead to bankcruptcy.

1.9.4 Why Transaction wise double book keeping

Six Eyed Concept generates a balance sheet where the double entries are projected. These double entries are hit on more than one account as well which is an evidence of double book keeping. The double book keeping is useful because if any scam or fraud occurs then it will be immediately reflected on the main transaction ledger to reflect on the balance sheet. This feature of six eyed concept is generated for each and every transaction in the system which would give us a clear picture of how a transaction is broken down into multiple accounts.

1.9.5 Why Rules Based Engine

Six Eyed Concept works on a rules based engine. It means that for generating a balance sheet it would strictly follow the rules. These rules are nothing but interpretations in form of debit and credit which occur on each of the use case (Input, Authorize and Settle).Because of rules based engine a rules based accounting system is formed .The rules based accounting system using six eyes is a unique feature .We need rules based accounting because it helps in litigation as when we setup a project we can file the rules in court so that we don’t fall into the trap of financial reporting. The rules based accounting saves us from any accounting fraud. It is strict and rigid. But it is robust as well. An innovative transaction would have innovative rules always .So that way it would be flexible as well.

1.10 Six Eyed Concept For Credit Risk(Divisional Patent #9)

1.10.1 The Limits

Every credit risk needs to have a limit.The limit is the range where we identify the boundaries for the credit risk to play within the system .Here we specify the maximum where the credit value has to be bound .This is the way we restrain the system .Whenever we cross this credit value we tend to be in credit risk and the credit in receivables either need to be authorised and confirmed or be deleted .

1.10.2 Definition of Credit Value

The credit value is dependent on receivables credit for a ledger or the whole system.This credit in receivables(outstanding value) which is not authorized should not exceed the difference between the debit in payables(amount settled) and credit in payables(settlement amount).This difference is the amount we have .The credit in receivables is the amount which should be within the limits.

1.11 Six Eyed Concept Rules for HRMS/Payroll (Divisional Patent #2)

1.11.1 Allowance

Enter Vehicle Reimbursement Allowance which would be slab allowance with some range .

1.11.2 Recovery

Enter Superannuation as percentage recovery with some percentage amount recovered from salary

1.11.3 Vehicle Reimbursement On Input

Credit Vehicle Reimbursement Receivables(Evidence of outstanding)

On Authorize

Debit Vehicle Reimbursement Receivables(Evidence of authorization) Credit Vehicle Reimbursement Payables(Evidence of settlement amount)

1.11.4 Superannuation

On Input

Credit Superannuation Receivables(Evidence of outstanding)

On Authorize

Debit Superannuation Receivables(Evidence of authorization) Debit Superannuation Payables(Evidence of settlement amount)

1.11.5 On Payroll -Part of Middle Office

Debit Vehicle Reimbursement Payables Settlement Amount(Evidence of allowance paid) Superannuation Payables Credit Settlement amount(Evidence of Recovery recovered)

1.11.6 Back Office On Settle

Clear all dues and tally the balance sheet

1.11.7 Settlement Amount For HRMS

The Settlement Amount for Allowance would be the amount that the system expects to pay to the employee and the settlement amount for recovery would be the amount expected to receive from the employee.

1.12 Six Eyed Concept Rules For Inventory(Divisional Patent #3)

1.12.1 Jobcard

On Input

Credit Jobcard Cost Receivables On Authorize

Debit Jobcard Cost Receivables Credit Jobcard Cost Payables

1.12.2 Material Requisition On Input

Credit Material Requisition Cost Receivables

On Authorize

Debit Material Requisition Cost Receivables Credit Material Requisition Cost Payables 1.12.3 Issues

On Input

Credit Issues Cost Receivables On Authorize

Debit Issues Cost Receivables Credit Issues Cost Payables

1.12.4 Purchase Order

On Input

Credit Purchase Order Cost Receivables

On Authorize

Debit Purchase Order Cost Receivables

Debit Purchase Order Cost Purchase Account

Credit Purchase Order Payables

1.12.4 Goods Receipt Note

On Input

Credit Goods Receipt Note Cost Receivables

On Authorize

Debit Goods Receipt Note Cost Receivables Credit Goods Receipt Note Cost Goods Receipt Note Account

1.12.5 Delivery Challan

On Input

Credit Delivery Challan Cost Receivables

On Authorize

Debit Delivery Challan

Cost Receivables

Debit Delivery Challan Cost Delivery Challan Account

Back Office -On Settle

Debit Jobcard Cost Payables

Debit Material Requisition Cost Payables

Debit Issues Cost Payables

Credit Purchase Order Cost Purchase Account

Debit Purchase Order Payables

Debit Goods Receipt Note